Real Estate Transaction Management

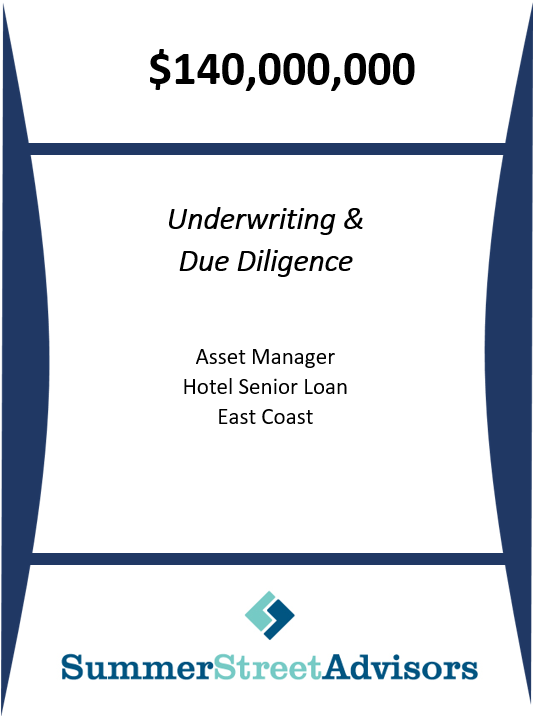

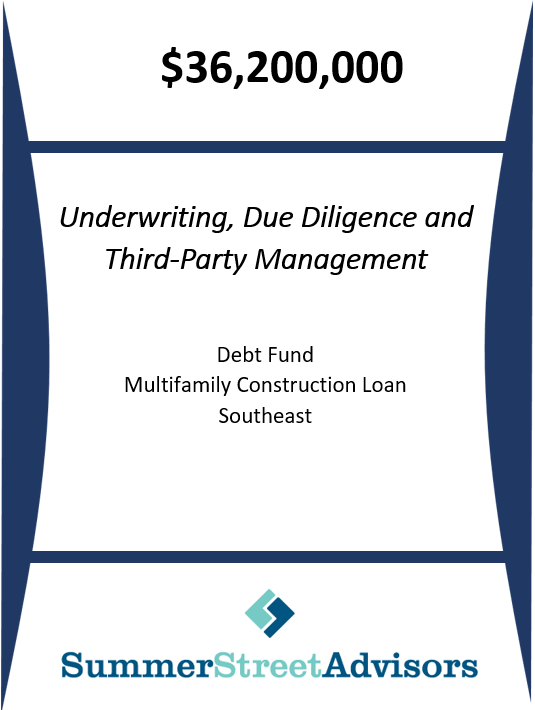

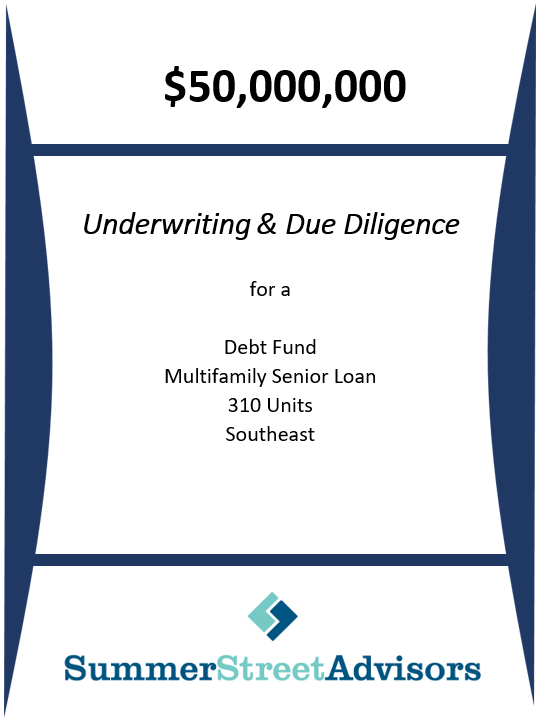

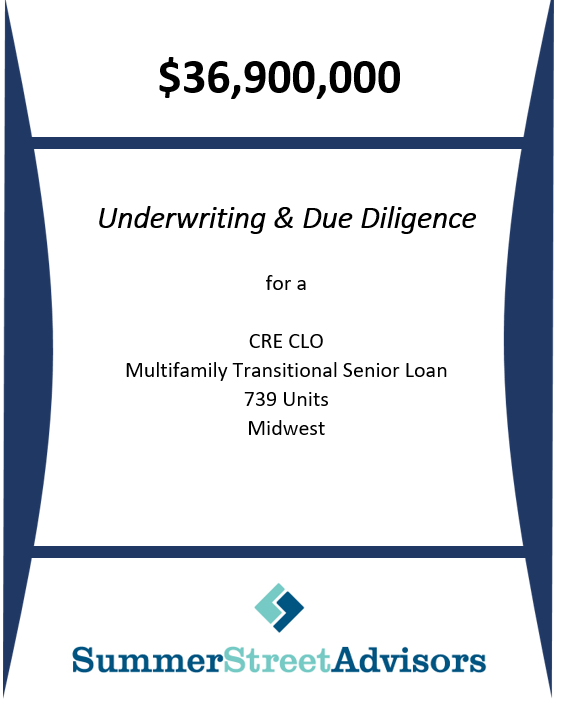

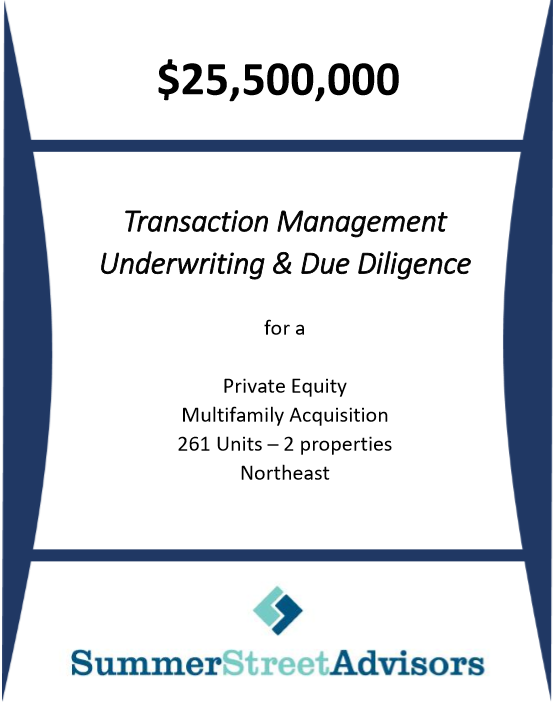

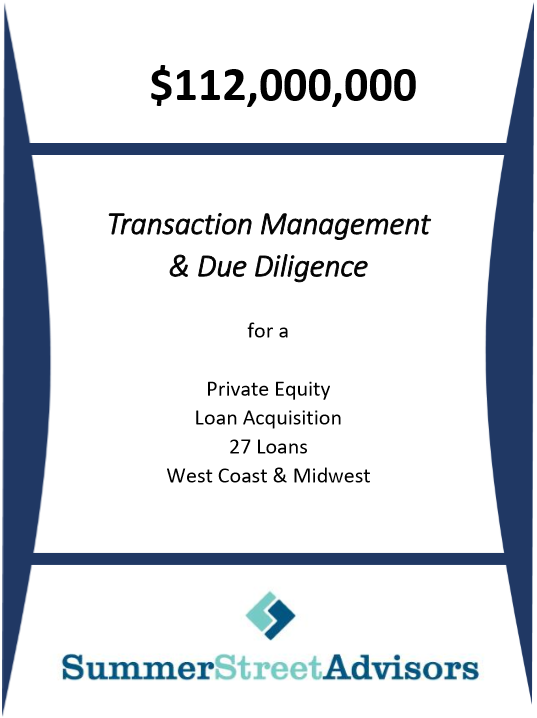

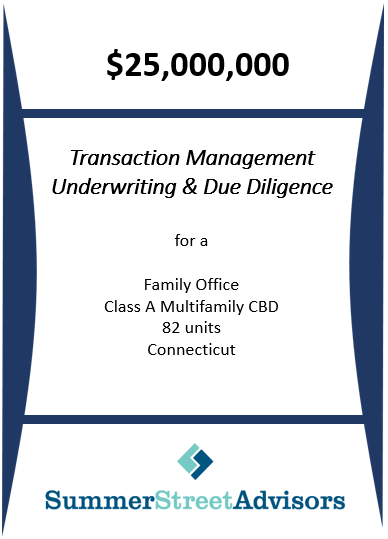

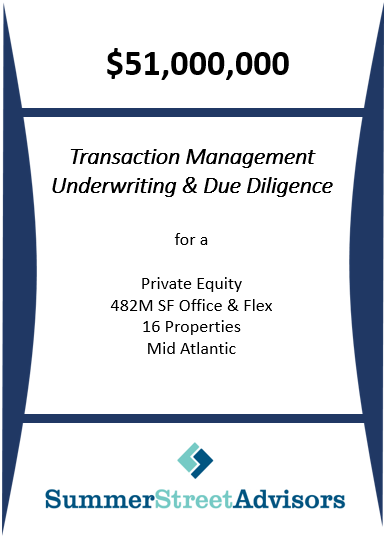

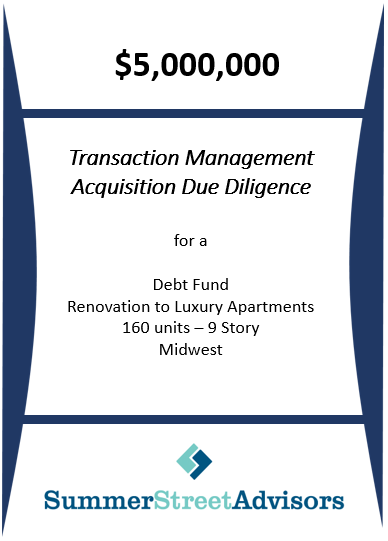

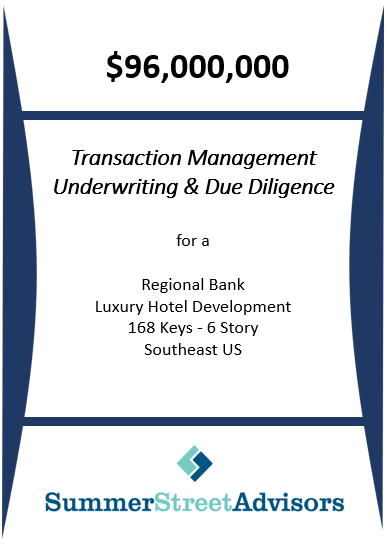

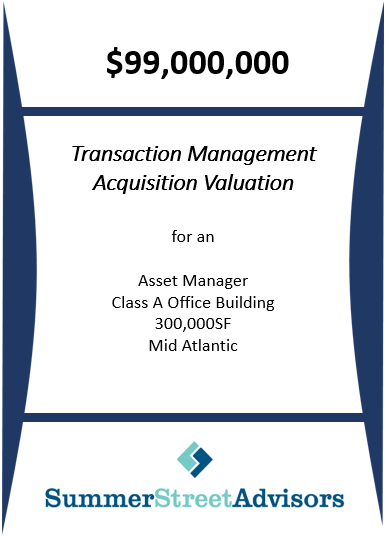

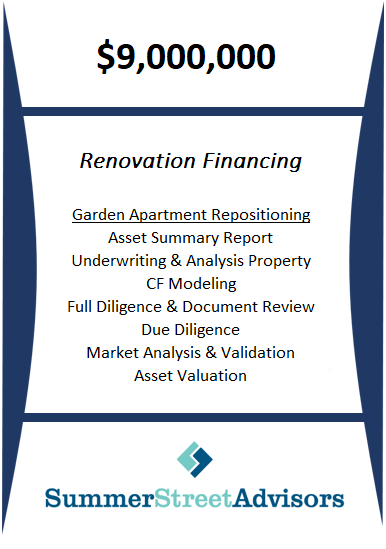

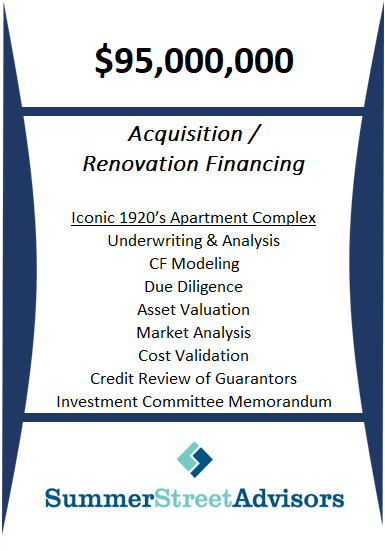

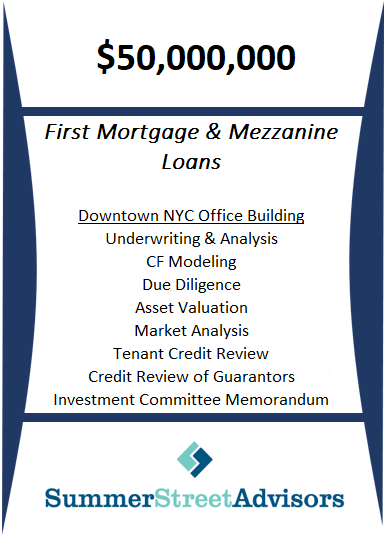

Summer Street Advisors has provided institutional insight to over $10B in CRE debt and equity assignments. We provide comprehensive market and deal level analysis to provide both debt and equity investors with the insight and rigor to validate an investment. SSA strives to provide comprehensive underwriting services to banks, funds and the securitization market to accurately assess and price risk with an institutional perspective.

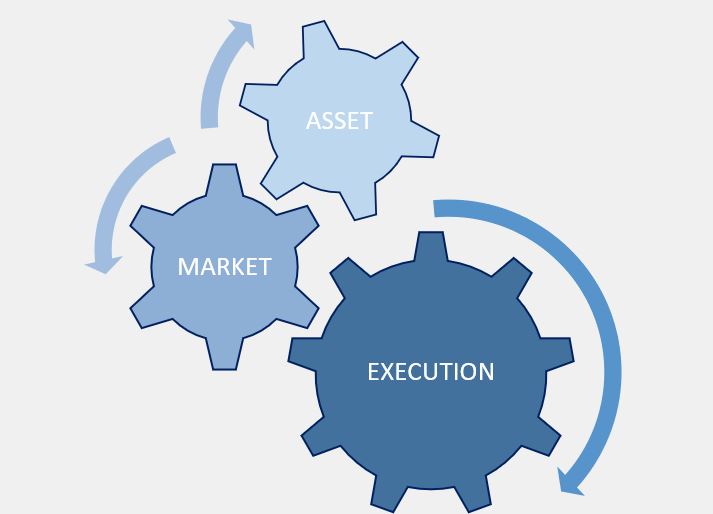

At SSA we provide a top down approach for analyzing single assets all the way up to large portfolios with a consistent process. Our execution frame work to diligence allows for a consistent evaluation of assets across markets and strategies. Our analysis is framed to define and assess the risk and mitigants of a transaction accompanied by developing an opinion of the benefits and potential pitfalls of an investment.

- Loan Structure, Borrower Business Plan Review

- UW Template Prepared & Analyzed

- Market Analysis

- Proforma with DCF and Return Analysis

- Sale & Rent Comp Analysis

- Preparation of Credit Memo

- Sponsor and Tenant Credit Review

- Sensitivity Analysis

- Sources & Uses Validation

- Management of Third Parties

- Due Diligence & Document Checklist

- Lease Review and Abstracts

- CAM Reconciliations

- AUP/NOI Audit

- Sponsor Budget, Expense & Proforma Review