Data Centers and CRE: What You Need to Know

June 6, 2025

Once a niche segment of industrial real estate, data centers have become one of the fastest-growing asset classes in the U.S. commercial property market. Fueled by the growth of artificial intelligence, cloud computing, and digital services, data centers are redefining investment priorities and development strategies across the United States. The data center market size was valued at USD 301.8 billion in 2023, and it is expected to grow at a compound annual growth rate of 10.1% during 2024-2030, reaching USD 622.4 billion by 2030. The revenue in the Data Center market is projected to reach US$452.53 billion in 2025, with Network Infrastructure dominating the market according to P&S Intelligence.

Major players like CoreWeave, backed by Nvidia, have expanded their footprint to 32 data centers across the U.S. and Europe, operating over 250,000 GPUs. In March 2025, CoreWeave secured a $12 billion, five-year cloud-computing contract with OpenAI, underscoring the sector’s momentum. Panattoni Development is also expanding into the data center market, planning to develop a gigawatt of capacity within the next five years.

Blackstone President and COO Jon Gray has described data centers as the company’s “highest conviction theme” – advancing its data center investment strategy with a $925 million debt facility to Colovore, a specialized data center operator focused on AI infrastructure.

Cities to Watch

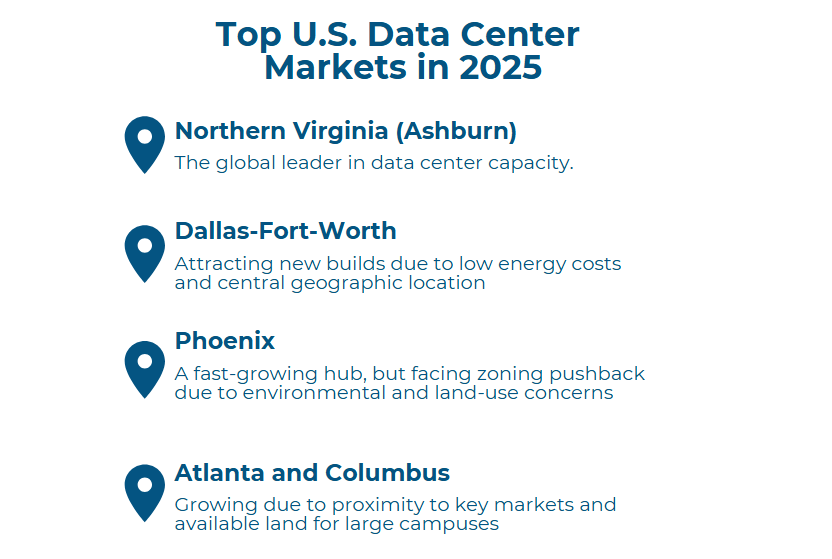

The Americas lead the data center market globally, according to Cushman & Wakefield’s newly released 2025 Global Data Center Market Comparison report. In the U.S., Virginia leads; the state alone accounts for a staggering 15.4 GW of planned capacity – the highest in the world. Virginia remains the largest data center market in the world, with operational capacity at 5.9GW, approaching the 6GW mark. Virginia’s operational data center capacity is larger than the combined capacity of the next three largest data center markets in the Americas. It also represents more than 25% of total operational capacity throughout North, Central, and South America. There are currently six established markets that have surpassed the 1GW operational capacity mark, with one expected to reach 2GW soon. The accelerated growth of the industry is driven by AI, machine learning, and cloud computing

Other leading markets include Phoenix, Dallas, and Atlanta – suburban and rural locations where land is abundant and power integration is more feasible. Georgia has emerged as one of the fastest-growing data center markets in the country, with companies like Amazon, Google, and Meta building data centers there.

Greater Phoenix has also been a leading market, due to the amount of available infrastructure, low likelihood of natural disasters, and its ability to offer low-latency connectivity to West Coast tech hubs. But there are also concerns; the City Council is evaluating new zoning regulations to manage the placement of data centers due to concerns over energy consumption and potential impacts on mixed-use communities.

In Texas, the ambitious $500 billion Stargate project, a collaboration between OpenAI, Oracle, and SoftBank, aims to expand existing AI infrastructure for OpenAI by building large-scale data centers for additional support across the nation. Construction has begun, but has faced delays recently due to tariff concerns.

The accelerated growth of the industry is driven by AI, machine learning, and cloud computing. Emerging markets are gaining traction due to shorter power delivery timelines and favorable land pricing, but established markets like Virginia still capture the bulk of activity.

Outlook for Investors

The data center boom presents significant opportunities for investors and developers. Institutional investors and real estate investment trusts are pouring capital into the space, drawn by high yields, long-term leases, and strong demand drivers.

However, the sector also faces challenges, including high energy demands, regulatory hurdles, and the need for sustainable practices. To combat concerns, some major developers are integrating on-site solar, using recycled water systems, and exploring modular and prefabricated builds to reduce carbon footprints.

Here’s what investors should know:

- This Is Not a DIY Asset Class

Most seasoned real estate investors agree: data centers require a specialist. Unlike traditional asset classes, data centers operate at the intersection of real estate, power engineering, fiber connectivity, and hyperscale computing. A misstep in understanding tenant needs can be the difference between a successful deal and a stranded asset.

Bring in experienced partners who know the technical and operational demands of this sector. Otherwise, you’re on the wrong side of the trade. Summer Street Advisors partners with select partners in this space to navigate these opportunities.

- The Amazon (and AI) Effect Is Real

Just as Amazon redefined logistics and retail real estate, AI hyperscalers are redefining data center demand. Demand is there, but only in the right places. Sites with access to affordable, reliable power and proximity to network hubs will outperform.

- Be Wary of “Fake Data Centers”

Not all “data center” investments are created equal. Some brokers are slapping the label on industrial shells without the infrastructure to support actual tenants. Without the right power capacity, cooling, or fiber, these buildings are just oversized warehouses.

- The Risk Isn’t Vacancy – It’s Obsolescence

Unlike office or retail, vacancy isn’t the primary threat in this sector. Obsolescence is. Technology evolves fast, and if your facility can’t adapt to higher-density computing or new cooling technologies, it becomes uncompetitive quickly.

Final Thought:

The opportunity is massive – but so is the complexity. For CRE investors, this is not a casual allocation. It requires deep understanding, technical partnerships, and long-term thinking.

About Jack Mullen of Summer Street Advisors:

As Founder & Managing Director of Summer Street Advisors, Jack Mullen leverages decades of experience in valuation, underwriting, and risk management to lead multi-million and multi-billion dollar CRE transactions.

Previously with GE Capital and large institutional banks, he has shaped investment strategies for some of the industry’s largest deals. A recognized leader, his insights are featured in GlobeSt.com and CREFC Finance World, and he is a sought-after speaker at industry conferences and top universities.

For strategic advice on your portfolio or transaction, contact:

jack.mullen@summerstreetre.com

Media Contact: