Building Tomorrow’s Care: Four Healthcare Trends Reshaping Commercial Real Estate

July 1, 2025

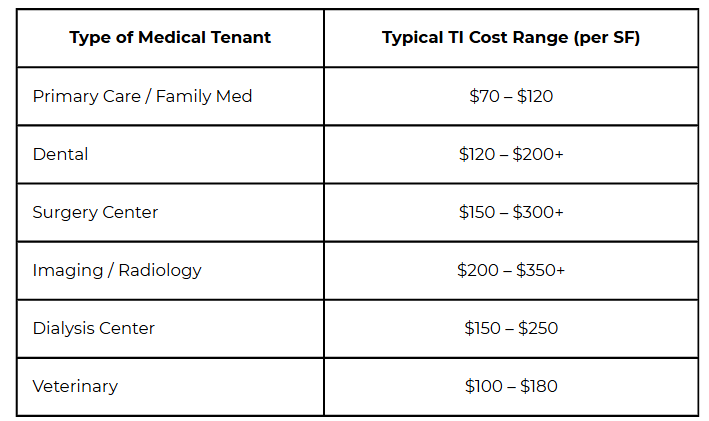

Healthcare real estate can be a strong investment, given that it is non-discretionary (people need it regardless of economic cycles) and because medical tenants typically sign long-term leases (10-20 years). They also invest heavily in customizing spaces, making them less likely to relocate, $70 to $200+ per square foot (PSF) depending on specialty, complexity, and location. By contrast, general office TI allowances often range from $40 to $60 PSF.

No longer confined to traditional hospital settings, healthcare delivery is shifting into new formats – requiring innovative real estate solutions. From outpatient expansion to tech-enabled facilities, these four emerging trends reveal how the CRE landscape is transforming in step with how care is being delivered.

1. The Rise of Medical Outpatient Buildings (MOBs)

The demand for healthcare services is shifting towards outpatient care. Healthcare tenants are seeking alternative spaces due to limited medical office availability. Private practice physicians (e.g., family medicine, internal medicine, pediatrics, and specialists) make up a large portion of the medical office demand nationwide by volume. Outpatient and retail health clinics (urgent care, primary care, physical therapy & behavioral health) are growing rapidly due to scalable business models (lower overhead than hospitals/expand rapidly across geographies) and consumer convenience trends (accessible/affordable/efficient).

MOB sales volume increased by 38% year-over-year to $2.5 billion in Q2 2024, experiencing heightened demand due to their convenience and cost-effectiveness. This trend is propelled by an aging population and the need for accessible healthcare services closer to residential areas. CBRE forecasts moderate but sustained growth in MOB sales volume, with annual increases of 8–15% likely over the next few years, barring major economic disruptions. The segment is well-positioned to outperform traditional office and some retail real estate sectors.

MOB employment is also rising (currently, 30% of healthcare professionals, and growing, work in outpatient facilities). Much of this growth is happening in hospital-adjacent MOBs. Major healthcare centers are increasingly moving their outpatient services to off-campus facilities that are within walking distance of their primary hospital.

2. Sunbelt Regions Are Leading Growth

While New England and the tri-state markets remain stable, Sunbelt states (Florida, Texas, Arizona & North Carolina), characterized by their growing populations and favorable climates, are witnessing a surge in healthcare real estate development. The trends are focused on:

Outpatient Care Expansion: There’s a significant move toward outpatient services, with outpatient volumes in the U.S. expected to grow by 10.6% over the next five years. This trend is fueling demand for medical outpatient buildings (MOBs), especially in Sunbelt regions where populations are expanding rapidly.

Off-Campus Development: Approximately 65% of new medical office developments are now located off traditional hospital campuses. This shift aims to bring healthcare services closer to residential areas, enhancing patient convenience.

Investor Interest: Medical office buildings are attracting significant investment due to their stability and resilience. In 2024, the sector saw a transaction volume of $18.2 billion, a 15% increase from the previous year.

As an example in Florida, AdventHealth has expanded its presence with new facilities, including an emergency room near Walt Disney World and a 375,000-square-foot distribution center in Apopka. The state’s favorable tax policies and growing population have attracted numerous healthcare providers and investors.

The Sunbelt’s favorable climate, economic opportunities, and demographic trends position it as a prime region for healthcare real estate investment. As the population continues to grow and age, the demand for healthcare facilities is expected to rise, making the Sunbelt a focal point for developers and investors in the healthcare sector.

3. Integration of Technology in Real Estate

Real estate companies gain over 10% or more in net operating income through more efficient operating models, stronger customer experience, tenant retention, new revenue streams, and smarter asset selection through use of AI, according to a recent McKinsey article. This is especially true for healthcare real estate.

The incorporation of technology, such as AI and telehealth capabilities, is becoming standard in new healthcare facility developments. These technological integrations enhance patient care and streamline operations, making properties more attractive to investors and tenants.

Algorithms can now analyze medical images with impressive accuracy, helping detect diseases like cancer earlier. Facilities are being redesigned to integrate smart technology and reduce the space once needed for back-office functions. Outpatient clinics with technological capability are also reducing the reliance on large hospital campuses.

Already, AI can analyze energy consumption data and suggest ways to make buildings more energy efficient. AI-based security systems are making healthcare buildings more secure, while robotic cleaning and other disinfectant technologies are making them cleaner.

4. A Focus on an Aging Population

With the baby boomer generation entering retirement age, there is an increased demand for senior living communities and specialized healthcare services. This demographic shift is prompting the development of facilities tailored to the needs of older adults.

According to CBRE, a disproportionate share of healthcare spending is driven by the higher-growth 65+ age cohort, which comprises just 17% of the U.S. population but accounts for 37% of its healthcare spending. By 2030, those over 65 will comprise 20% of the population in the U.S., and seniors are expected to increase total outpatient healthcare spending by 31% over that time to nearly $2 trillion.

In conclusion, healthcare real estate offers stability, long-term growth potential, and reliable income, especially for investors focused on defensive assets. It’s not risk-free (for example, specialized buildouts make properties harder to repurpose for other uses). But it can be a smart, strategic addition to a CRE portfolio, especially when it comes to outpatient facilities.

About Jack Mullen of Summer Street Advisors:

As Founder & Managing Director of Summer Street Advisors, Jack Mullen leverages decades of experience in valuation, underwriting, and risk management to lead multi-million and multi-billion dollar CRE transactions.

Previously with GE Capital and large institutional banks, he has shaped investment strategies for some of the industry’s largest deals. A recognized leader, his insights are featured in GlobeSt.com and CREFC Finance World, and he is a sought-after speaker at industry conferences and top universities.

For strategic advice on your portfolio or transaction, contact: