Covid Impact on CRE Values

March 2, 2021

The net of my overall insight is – During Covid, there are winners and losers – some have benefitted – industrial/multi – whereas others have been hurt-marginalized – office – retail.

Covid’s impact on CRE values varies based on asset type (industrial, multi-family, office, and retail) across the U.S. Some of the impacts are temporary disruptive changes while other are fundamental deteriorations that have only been accelerated with COVID-19.

As the current darling of CRE, industrial has seen an acceleration in demand for space across the U.S. Over the last year, the $2 trillion asset value/17.2 billion square foot industrial market has seen 300 million square feet of new industrial space delivered with another 339 million square feet under construction. While transaction volume is down 31.1% over last year, $63.6B transacted at a market cap rate of 6.6% according to the CoStar National Index. Industrial real estate fundamentals have been exceptionally strong over the past few years, due to the rise of e-commerce. This trend should continue throughout the COVID-19 crisis, as logistics demand is higher than ever with local and national stay-at-home guidelines.

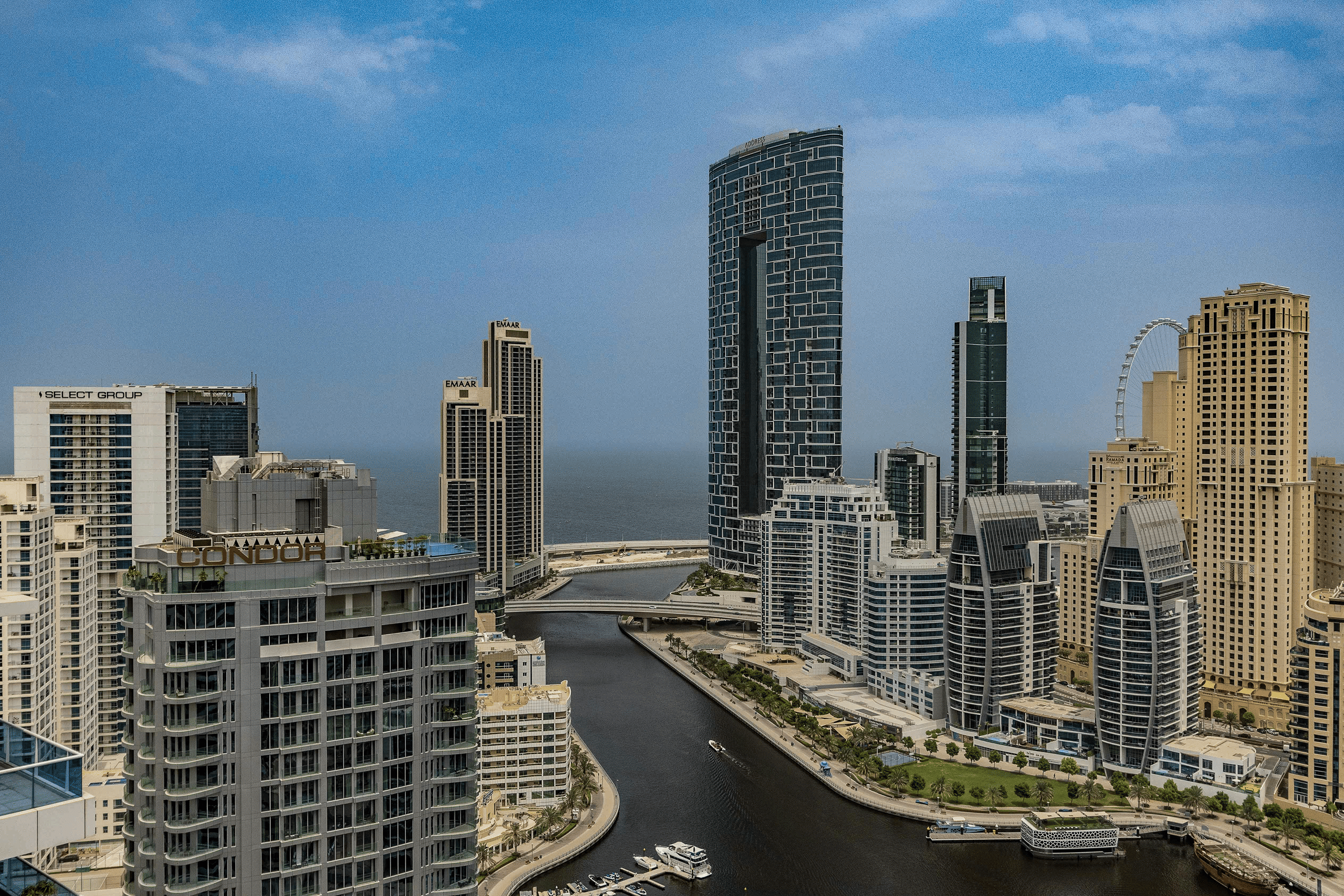

For multi-family, the story is more complex depending on where the apartments are located (North/South/West) and what type of property (A/B/C). The 3.7 trillion square foot/17.5-million-unit apartment market has seen 403,084 units delivered with another 562,533 units under construction. While transaction volume is down 38.3% over last year, $104B transacted at a market cap rate of 5.5% according to CoStar based on the CoStar National Index. Collections have been better than expected, but there has been softness in B/C properties where tenants have work that is tied to sectors affected by COVID-19. Generally, rent collections have been higher for multi-family than for other property types. The suburbs have also seen a huge increase in demand whereas metro centers like NYC and Chicago have suffered (higher vacancy, concessions, negative rent growth).

For office, the story and future are uncertain. The $2.7 trillion value/8.1B square foot office market has seen 53.5 million square feet delivered with another 150 million square feet under construction. While transaction volume is down 52% over last year, $58.5B transacted at a market cap rate of 7.1% according to CoStar based on the CoStar National Index. Many workers have been successfully working remotely and enjoying the additional flexibility. The change to date has been limited in terms of reduction in values, but the long-term trend is uncertain. Many businesses are reviewing their long-term commitments to office space. The COVID -19 impact on the office segment will take longer to play out, as much is dependent upon how office users react to the new experience of having large segments of their workforce working remotely. In general, this experience has gone better than expected. Many companies are planning to keep an increased level of remote work as part of their business model going forward.

Retail faces many head winds – lenders and investors want to exit. The $2.5 trillion value/11.6B square foot retail market has seen 47.8 million square feet delivered with another 45.3 million square feet under construction. While transaction volume is down 33.5% over last year, $45.3B transacted at a market cap rate of 7.1% according to the CoStar National Index. Many think of the outmoded mall or big box retailer that has not been relevant for many years, however COVID-19 has only accelerated the demise of marginal real estate that needs to be re-invented or repurposed. Within the retail property sector, malls have been the most negatively impacted and expectations are that they will also take the longest to recover. Retail malls have faced an increasingly challenging environment for several years, primarily driven by shifting consumer behavior. COVID-19 has accelerated the changes that were already happening.

About Jack Mullen of Summer Street Advisors:

As Founder & Managing Director of Summer Street Advisors, Jack Mullen leverages decades of experience in valuation, underwriting, and risk management to lead multi-million and multi-billion dollar CRE transactions.

Previously with GE Capital and large institutional banks, he has shaped investment strategies for some of the industry’s largest deals. A recognized leader, his insights are featured in GlobeSt.com and CREFC Finance World, and he is a sought-after speaker at industry conferences and top universities.

For strategic advice on your portfolio or transaction, contact:

jack.mullen@summerstreetre.com

Media Contact: