Extend and Pretend’ is Over—What’s Next?

March 10, 2025

For years, lenders and property owners relied on optimistic market forecasts to push debt issues down the road. Last year, the industry mantra was “Survive to ‘25” – in hopes that interest rates would decline, and the market would reset.

Unfortunately, that hasn’t happened, and there are no significant indicators that interest rates or property values will shift in the near future. The market is no longer offering easy exits – but there are still some strategic opportunities for investors.

The era of extending and pretending in real estate is over.

Key Takeaways:

- Rates are unlikely to change this year.

- Profitability will be fueled by creating value through active execution rather than relying on a passive investment strategy.

- Strategic, well-informed decisions are opening up market opportunities, especially in the Midwest and multifamily housing sectors.

Cap Rate Compression

The days of relying on cap rate compression to drive profitability are over, signaling a fundamental shift in real estate investment dynamics.

For years, investors benefited from declining cap rates, which drove property values higher and allowed for strong returns with minimal operational improvements. However, with rising interest rates, tightening credit conditions, and increased market uncertainty, those tailwinds have disappeared.

Real estate investors are shifting their focus toward fundamental value creation rather than passive appreciation. This means improving asset performance by making capital improvements to properties, making them more appealing to both buyers and tenants. Improvements include aesthetic upgrades, energy efficiency upgrades, and additional amenities and services. Another trend we’re seeing is adaptive reuse and mixed-use conversions.

Debt structuring has become more critical than ever. Now with interest rates significantly higher than in previous years, investors can no longer rely on cheap debt to amplify returns. Many are turning to creative solutions, like structured financing, mezzanine debt, or preferred equity. And financial institutions are increasingly bringing in partners to recapitalize real estate deals or provide operational expertise. Financial firms are working with private equity firms, institutional investors, or high-net-worth individuals to inject new capital into distressed or underperforming assets.

Non-Performing Loans: A Market Challenge

Property owners, developers, and financial institutions are navigating prolonged borrower fatigue – as struggling borrowers, particularly in commercial and multifamily real estate, are not meeting their debt obligations due to declining property values, increasing expenses, and slowing rent growth.

Lenders are reaching critical decision points of whether to continue restructuring loans in the hope of a market rebound or to sell off distressed assets to reduce risk. In September, Fannie Mae announced the sale of 1,766 deeply delinquent loans totaling $296.7 million in unpaid principal balance, as part of the company’s effort to reduce the size of its mortgage portfolio.

Offloading non-performing loans can provide immediate liquidity, but it often comes at the cost of significant valuation write-downs. Conversely, recapitalizing assets—whether through new equity, debt restructuring, or joint ventures—offers a potential path forward but requires substantial time, effort, and market confidence.

Opportunities in Multifamily Housing

Multifamily housing is a strong opportunity for real estate investors in 2025, driven by several key factors:

- High housing costs and elevated mortgage rates continue to make homeownership unaffordable for many, sustaining strong rental demand.

- Reduced new construction has created favorable conditions for rent growth and occupancy stability.

- Property owners who face loan maturities might be forced to sell at discounted prices, offering attractive acquisition opportunities for well-capitalized investors.

In 2024, the U.S. rental housing market saw a stabilization in the multifamily sector while Single-Family Rentals experienced fluctuations.

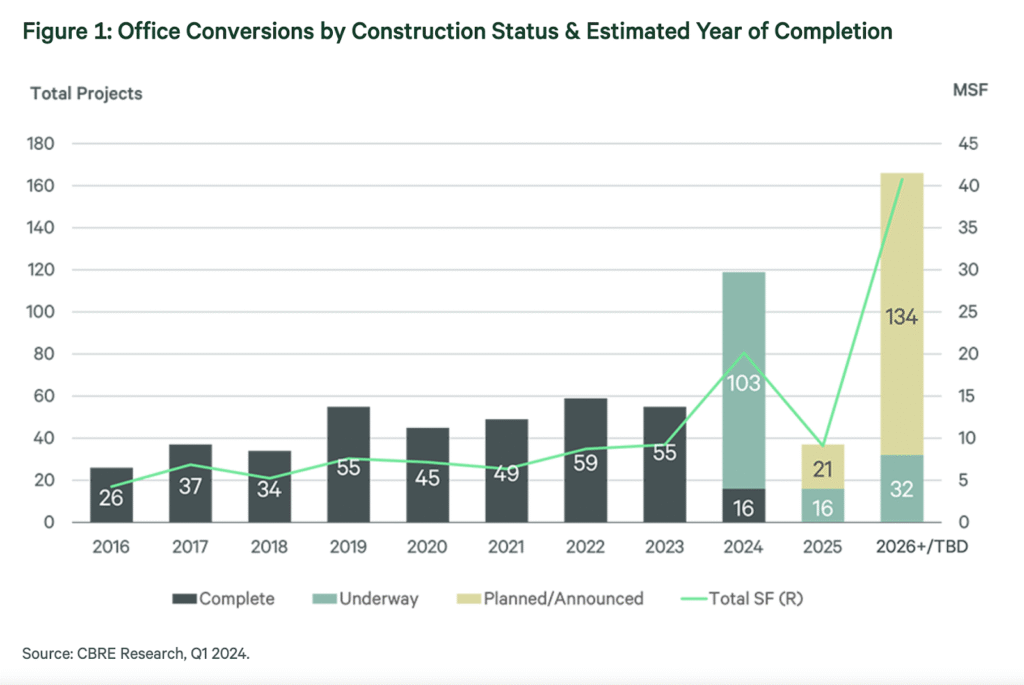

Despite an increase in return to office mandates, a fifth of the nation’s office space still remains empty. As a result, cities across the country are easing or ending regulations and cutting red tape to make conversions more affordable. Between 2016 and April 2024, office-to-multifamily conversion projects created more than 22,000 apartments, according to CBRE, but projects currently planned or underway are estimated to produce another 31,000 apartments over the next several years.

Lenders are reaching critical decision points of whether to continue restructuring loans in the hope of a market rebound or to sell off distressed assets to reduce risk. In September, Fannie Mae announced the sale of 1,766 deeply delinquent loans totaling $296.7 million in unpaid principal balance, as part of the company’s effort to reduce the size of its mortgage portfolio.

Offloading non-performing loans can provide immediate liquidity, but it often comes at the cost of significant valuation write-downs. Conversely, recapitalizing assets—whether through new equity, debt restructuring, or joint ventures—offers a potential path forward but requires substantial time, effort, and market confidence.

And even with these conversions, office space, long seen as an unstable asset class, is beginning to show signs of recovery, particularly for well-located, well-amenitized properties. The cousin of office, retail, faces similar dynamics, with certain submarkets showing resilience.

The Midwest: A Growth Opportunity in 2025

While some regions are experiencing volatility, the Midwest stands out as a stable and mature market. Unlike high-growth coastal cities that are more susceptible to market swings, Midwestern cities like Chicago, Columbus, Indianapolis, and Minneapolis offer economic stability, affordability, and strong demand drivers.

A key factor fueling this stability is the onshoring of U.S. manufacturing and logistics jobs. With recent tariffs, companies from Bath & Body Works to Pfizer have been onshoring to mitigate risks. As a 2024 Forbes article put it: “This shift toward onshoring isn’t just about nostalgia for the good old days of American manufacturing. It’s about building resilience into our supply chains, reducing our dependence on foreign sources, and yes, bringing jobs back home.”

Columbus has seen significant investment from major tech and semiconductor firms (like AWS and Cologix) while Chicago remains a key financial and logistics hub. And The midsize city of Canton, OH, ranked No. 1 in the latest Wall Street Journal/Realtor.com® Housing Market Ranking.

This US manufacturing resurgence is creating sustained demand for multifamily housing, retail space, and industrial facilities, making the Midwest an attractive destination for real estate investors looking for predictable cash flow and long-term appreciation.

Conclusion

While the end of “extend and pretend” signals a more disciplined and selective investment environment, it also paves the way for a healthier, more sustainable market.

The forced recalibration in lending, valuations, and asset performance will ultimately reward investors who take a proactive approach, whether through recapitalization, strategic acquisitions, or adaptive reuse projects. As 2025 unfolds, success in real estate will no longer be dictated by passive market trends but by the ability to create, optimize, and sustain value.

Read our outlook for 2025 and how to navigate this shifting landscape.