GSA Lease Terminations: A Market Reckoning or an Investor Opportunity?

April 7, 2025

John F. Kennedy Federal Building in Boston reportedly headed for sale | Photo source: GSA.gov

The commercial real estate sector is in the middle of a major correction, and the latest pressure point is coming from the federal government.

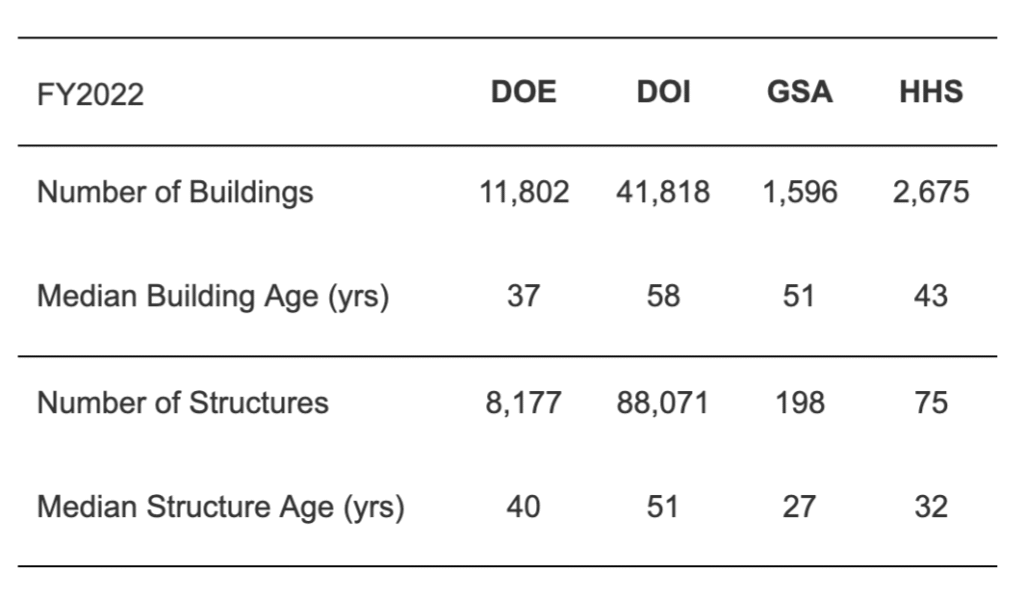

As agencies downsize their real estate footprint, General Services Administration (GSA) leases are being terminated, leaving behind a trail of outdated, often obsolete office buildings (see Table 1).

Source: GAO, Federal Real Property: Agencies Should Provide More Information About Increases in Deferred Maintenance and Repair, GAO-24-105485, November 2023, at https://www.gao.gov/assets/d24105485.pdf.

Note: These data from GAO are as reported in the Federal Real Property Profile for FY2022.

In early March, the General Services Administration announced the termination of about 1,000 federal office space leases nationwide (about 13% of its portfolio). Most of these are in the DC or New York areas, but GSA also has offices in locations ranging from Kansas City, Missouri to Anchorage, Alaska. While it walked back some of those terminations, hundreds of lease terminations are still in effect. This news is hitting an already fragile market, adding downward pressure on valuations and pushing lenders, owners, and investors into critical decision-making mode.

GSA often signs five-year leases, with the option of renewing for another five years (which it typically did, in the past). But for those holding the debt on these properties, the sudden loss of a government tenant – once seen as a secure, long-term cash flow – creates a challenge.

Key Takeaways:

- Depending on how these buildings were financed, loan covenants are under strain, and lenders are being forced to reevaluate their exposure.

- Owners are left holding assets that, in many cases, are older, outdated and difficult to reposition in a market where tenants have all the leverage.

- Many of these buildings are hitting the market at deep discounts, creating potential opportunities for investors.

Lenders: Scrambling for a Strategy

Many of these properties were financed under the assumption that government-backed leases provided stability. Depending on the structure of the financing, some lenders may be looking at covenant breaches, while others may have to decide whether to foreclose, restructure, or offload the debt at a discount. If the owner defaults, the lender may have to foreclose and take ownership of the property.

Now that funding cuts are leading to immediate exits, the biggest problem is that many of these properties being vacated are older and in less desirable locations, making them harder to re-lease. Many GSA-occupied properties have been in government hands for decades. They’re not modern buildings that can easily be repositioned; they’re assets that require significant capital to bring up to market standards. The most recent estimate for federal civilian agencies’ deferred maintenance and repairs on their buildings was a staggering $80 billion.

Owners: Renovate, Sell or Repurpose?

In today’s office market, replacing any large tenant is a challenge, but it’s even more difficult to replace a government lease that may have propped up an otherwise underperforming property.

Here are the options for owners:

- Renovate – If the location is strong, some properties may warrant reinvestment, but this requires significant capital at a time when financing is expensive.

- Sell at a discount – For many owners, the best option may be to cut losses and sell, but with an oversupply of struggling office properties on the market, pricing expectations need to be adjusted.

- Redevelop or repurpose – Some buildings may have potential for conversion to residential or mixed-use properties (especially in cities where state and local governments are offering financial incentives), but not all locations will support this shift.

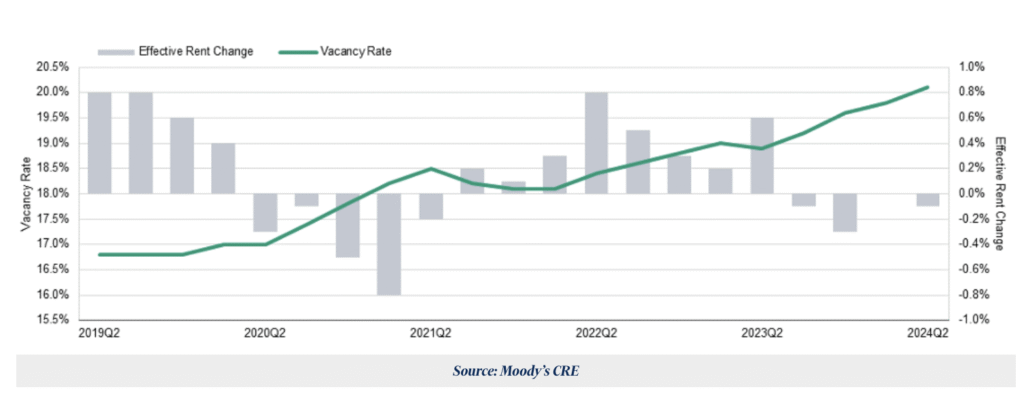

Chart 1: Office Rent and Vacancy Trend

At the end of 2024, office vacancy rates were already at a 30-year high. The good news is that sales of office buildings jumped 21% from 2023 to 2024 (See Chart 1), and leasing activity is also gaining momentum, according to a report by CBRE. But the momentum is typically around Class A buildings.

The office vacancy rate in D.C. ended 2024 at 19.9%. Most of these are Class B and Class C buildings (like GSA buildings). Asking rents for Class A trophy office space in D.C. is actually at a record high, because tenants can afford to be pickier about the amenities they demand.

Now that funding cuts are leading to immediate exits, the biggest problem is that many of these properties being vacated are older and in less desirable locations, making them harder to re-lease. Many GSA-occupied properties have been in government hands for decades. They’re not modern buildings that can easily be repositioned; they’re assets that require significant capital to bring up to market standards. The most recent estimate for federal civilian agencies’ deferred maintenance and repairs on their buildings was a staggering $80 billion.

Investors: Fire-Sale Pricing

For investors, the wave of GSA lease terminations presents an undeniable opportunity – but one that comes with risks. Many of these buildings are hitting the market at deep discounts, creating potential for value-add plays. The key is knowing which assets are worth repositioning. For example, some high-value, historically significant properties in the heart of DC are expected to go up for sale.

Some buildings may be salvageable with the right vision and capital investment, particularly those in strong submarkets with demand for alternative uses. Others will need to be demolished and redeveloped from the ground up. Investors who can execute on creative repositioning strategies will find opportunity in the unpredictable market.

The Bigger Picture: A Market Under Pressure

For owners and lenders, the GSA’s downsizing presents a challenge, especially for outdated buildings with limited reuse potential.

But for investors, this is an interesting opportunity. For example, some of the buildings reportedly headed for sale include the John F. Kennedy Federal Building in Boston, and the John C. Kluczynski Federal Building in Chicago, which was designed by renowned architect Ludwig Mies van der Rohe.

The bigger question is, how will these lease vacancies affect the recovery of the office sector? As office owners across the country struggle with decreased demand, shifting tenant preferences, and an overall decline in asset values, the addition of these buildings to an already saturated market could extend the timeline for recovery.

Some buildings may be salvageable with the right vision and capital investment, particularly those in strong submarkets with demand for alternative uses. Others will need to be demolished and redeveloped from the ground up. Investors who can execute on creative repositioning strategies will find opportunity in the unpredictable market.