What Do Tariffs Mean for Commercial Real Estate?

May 5, 2025

Tariffs are disrupting global supply chains, likely making construction materials and imported components more expensive. President Trump’s announcement of global tariffs have sent markets into a tailspin. Execution risk is rising, and caution is becoming the prevailing mindset. But could disruption be good for CRE? Possibly. While the coming months will see some volatility, long-term changes could position CRE investors for the next chapter of growth.

The Downsides

While some investors see real estate as a safer investment than the stock market right now, others are wary of the impact tariffs will have. With mortgage rates hovering around 7%, “we are in a time of great crisis, really, from a housing perspective,” Nectar CEO Derrick Barker shared in a recent interview.

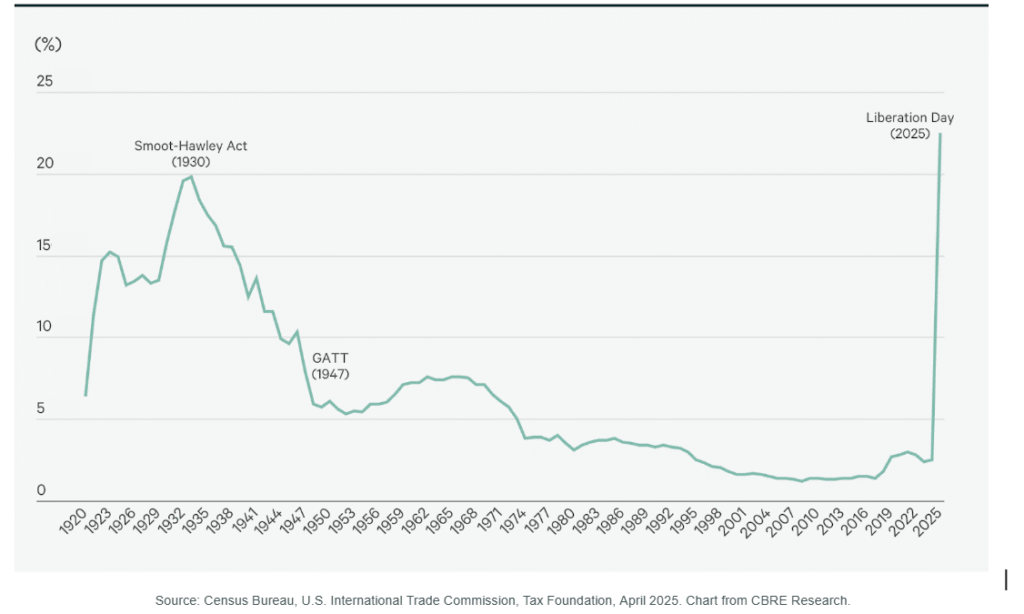

Average Effective U.S. Tariff Rate

1. Higher Construction Costs:

Tariffs are disrupting global supply chains, likely making construction materials and imported components more expensive. A Trammell Crow Company internal analysis (April 2025) found that construction costs for commercial projects could increase by approximately 5%, which could persuade developers to put some new projects on hold.

For developers and investors, this makes the cost of new projects uncertain, squeezing margins and raising questions about return on investment at a time when financing is already tighter.

2. International Investment:

International investors have viewed U.S. real estate as a relatively stable investment, but some are reassessing their positions. Many foreign capital sources are pressing pause until there’s greater clarity. This could reduce competition for assets in the near term, but it also underscores the importance of maintaining financial discipline and focusing on fundamentals amid shifting global capital dynamics.

3. Strain on Less Desirable Areas

Tariffs are likely to put further strain on less desirable or economically fragile areas of the country, like Rust Belt cities. Institutional capital will continue to concentrate in top-tier metros and growth markets that offer more predictable returns. Tariffs add an extra layer of uncertainty that makes investors even more reluctant to deploy capital in some areas.

The Upside

However, many investors will follow Blackstone’s lead. Blackstone, the world’s largest owner of commercial real estate, said it is embracing opportunities for acquisitions amid the tariff uncertainty. In the first quarter, Blackstone’s core-plus real estate investments (those in relatively stable, income-generating, high-quality real estate) posted a 1.2% gain.

1. Onshoring:

In some sectors, tariffs could act as an accelerant for growth. The push to onshore manufacturing and strengthen domestic supply chains is creating tailwinds for industrial real estate, leading to a surge in demand for domestic warehousing and logistics facilities. This shift benefits the industrial real estate sector, especially in key markets like New Jersey and Los Angeles, where leasing by Asia-based firms has notably increased.

2. Office:

Office leasing activity was up 23% year over year in the last months of 2024, and select office markets will hold firm despite broader sector pressures. With return-to-office mandates continuing, leasing activity has remained strong, and CBRE expects that prime assets in major markets will continue to outperform.

3. Multifamily and Retail:

Retail and multifamily sectors will remain resilient, so long as affordability and consumer confidence are managed carefully. Demand in both these sectors is relatively strong, making them better able to withstand uncertainty (New York City’s multifamily sales were up 62% year-over-year in Q1, for example). The U.S. retail space market, with about 12.2 billion square feet, remains close to its historic low at 4.2%.

For CRE investors, the path forward is about balance. Staying agile, making incremental moves, and keeping balance sheets strong will be essential strategies in the months ahead. Tariffs are likely to create short-term bumps, but they also hold the potential to reshape the U.S. economy in ways that ultimately benefit domestic-focused real estate investors.

Those prepared to navigate the volatility — and move decisively when opportunities emerge — will be well positioned for coming growth.

About Jack Mullen of Summer Street Advisors:

As Founder & Managing Director of Summer Street Advisors, Jack Mullen leverages decades of experience in valuation, underwriting, and risk management to lead multi-million and multi-billion dollar CRE transactions.

Previously with GE Capital and large institutional banks, he has shaped investment strategies for some of the industry’s largest deals. A recognized leader, his insights are featured in GlobeSt.com and CREFC Finance World, and he is a sought-after speaker at industry conferences and top universities.

For strategic advice on your portfolio or transaction, contact: