Tapping the Brakes: A Slowdown Beats a Crash

March 17, 2016 — As an avid cyclist, I’ve learned to appreciate and adapt to the changing seasons, especially in New England. If only real estate investment cycles were as predictable as the seasons.

Business NOT as Usual

February 9, 2016 — Is there anything worse for a commercial real estate property and investment than a failing business tenant? Everything about the deal seemed right; so what went wrong?

Interest Rate Rise May Affect RE in a Roundabout Way

January 21, 2016 — When the U.S. Federal Reserve in December raised the benchmark interest rate for the first time since 2006, the commercial real estate industry yawned. The hike was just 25 basis points, leaving plenty of spread between interest rates and investment cap rates, and real estate professionals had been anticipating an increase for years. In addition, there is so much equity capital focused on U.S. property markets that many buyers are focused on getting as much money placed as possible—and adding leverage runs counter to that goal.

The Best of Times. The Worst of Times.

October 13, 2015 — It’s the best of times and the worst of times for the CMBS market, as a wave of big conduit deals in the pipeline comes up against investors who are increasingly wary of the strength of underwriting on those deals.

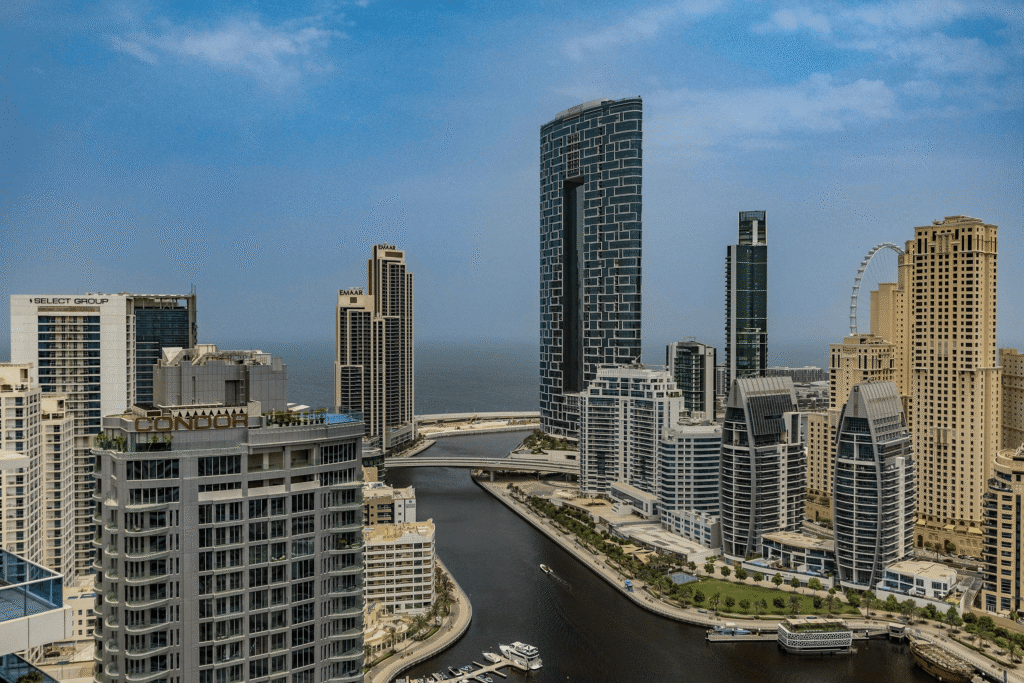

Private Wealth Investors Find Opportunity in Real Estate

August 28, 2015 — When stock market and hedge fund investments turned down during the recession, family offices and other private wealth investors turned to commercial real estate as a way to get a favorable income stream and long-term appreciation. The volume of family office investment in the U.S. grew dramatically, fueled by both foreign and domestic investors, who initially found a buyer’s market. But what has happened to family office investment now that institutional players like pension funds and sovereign wealth funds are bidding up prices and pushing down cap rates?